All innovative ideas require adoption, people using them, and giving feedback to improve and be better. Who are the people using it, and what kind of feedback given is what determines the development of the product.

The broader the target audience, the more variety of feedback you want so that what is built is truly inclusive. Therefore, it makes sense that you want to get the widest swathe of people using the products so that the feedback provided is representative of its users. This will then ensure that whatever is being developed addresses the concerns raised and will be something suitable and useful for everyone.

The model described above applies to crypto perfectly.

How you go about getting people to use crypto relies in large part on two key elements intricately linked with each other: education and accessibility. Of the two, accessibility is the more important one because it also covers accessibility to education, not just crypto.

In this article, we talk about who is not yet able to access crypto, education, or both, and what can be done about it.

How New Ideas Work

It's no exaggeration to say that the world is built for the masses. This approach makes the most economical sense. One starts with something that most people can use to gain traction, get the feedback coming in, and then work towards perfecting the result.

Once the final version is more or less settled, then there might be some consideration given to those who aren't covered in the initial target group. I say “might” because a lot of times, people tend to chase after the next new thing instead of spending time refining it for fringe groups who were not initially included.

Those who do take time to do so might find that it would either require a minor adjustment (think scissors for right-handed vs lefties) or a complete rethink, which might result in going back to square one. Assuredly, very few would want to start from scratch again if the problem is deemed to be solved in the first place. Instead, we just ask the fringe groups to adjust themselves to the masses as part of the price of living in a society that works for most people.

A good example of this is car seatbelts. The item was designed for male physiology initially and to this day, there isn't a version for women. The argument might be that cars are gender-neutral so that men and women can drive the same car. Very well. Then how about the crash test dummies used to test for car safety?

Most are designed with the male physiology in mind of average height (whatever that may mean), even though women drivers are a common sight. Is it any wonder that they are less likely to survive a fatal car crash than men?

State of Crypto Development

There are times when the fringe groups get skipped over too many times and enough development has gone ahead that allows them to leapfrog to the forefront. The popularity of e-wallets and digital payments got started in Asia because many countries did not have the infrastructure rails or resources to build them like what is already a norm in developed countries. Thus, when the technology for digital payments came about, this was quickly adopted by developing countries because it allowed them to catch up or even be ahead of the rest of the pack. Developed nations are slower to catch on simply because there is less incentive to do so.

This is pretty much the state of crypto now.

In the 2023 Global Crypto Adoption Index report issued by Chainalysis, a prominent blockchain firm that specialises in providing tools for tracing crypto funds, 9 of the top 10 countries in global crypto adoption come from developing nations. This group is referred to as Lower Middle-Income (LMI) countries in the report. Even as global crypto adoption has slowed down, global adoption in the LMI group remains stronger than before. Add to the fact that around 40% of the world's population are in LMI countries and it's easy to infer where the bulk of crypto users will be coming from.

The Problem Facing Crypto Development

Before we begin, let's look at a few hard facts:

- Crypto is a product of technology.

- The earliest people involved in crypto were computer programmers or someone with a tech background.

- The second type of people who got interested in crypto were those with a finance background.

Technology and finance have traditionally been male-dominated industries. Therefore, it is no surprise that the early adopters who got into crypto were overwhelmingly male. The standard perception of a crypto user is thus: tech-minded, young, male, smart, finance-savvy, and in some cases, well-to-do people or those who have extra cash put aside. This perception persists to this day, more than 10 years after crypto was born. For crypto to truly be adopted by the masses, the perception of a standard user needs to change.

Changing this perception requires effort on all fronts. While we like to think that everyone is equal, the reality is that we're not. Whether due to physical makeup, intelligence level, mode of learning and knowledge absorption, or levels of understanding, there is certainly no one-size-fits-all to anything. The first step towards making a change in perception starts with education. The more people know about crypto, the more of a chance they have to choose to interact with it and see for themselves what it's all about.

Where to begin the education process and how it can be accessed differs amongst various groups of people. The groups that we are going to highlight below are usually known as minority groups in general society. We're going to look at the problems they have in accessing education and also assess whether they have difficulty accessing crypto the way things are now.

Women in Crypto

Some might find it ridiculous to consider women as a minority group and they may be right to think so. Globally, the ratio of men and women is just around the 50-50 mark (based on the gender of the baby at birth). If we apply the lens of crypto usage/adoption to this metric, it paints a starkly different picture:

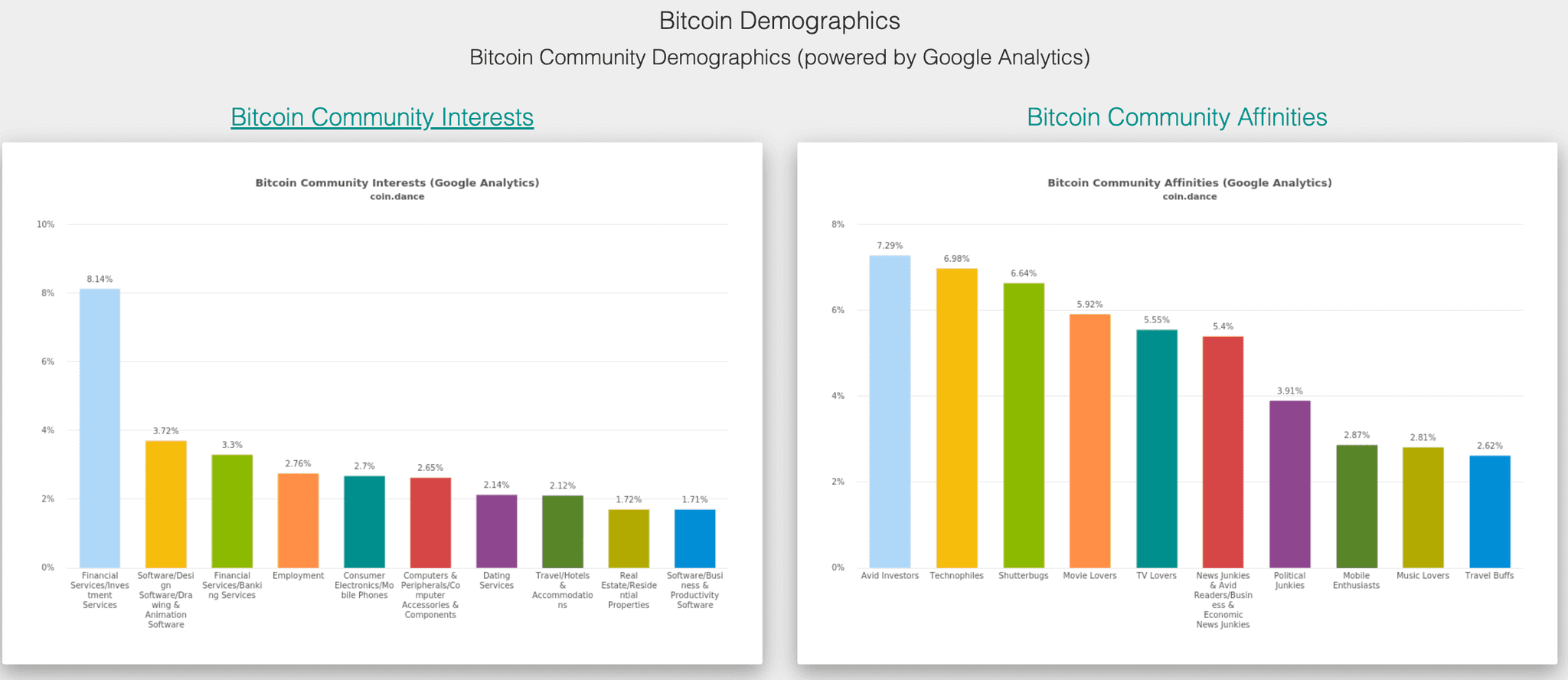

Granted, Bitcoin community engagement is not representative of blockchain engagement in general, yet it's likely a close approximation of the gender gap in crypto. Another set of stats about crypto users may perhaps provide a clearer illustration of the problem at hand:

Another point to consider is that women are generally less risk-averse than men and crypto is nothing if not risky. While branding crypto as a high-risk activity (which it is) is meant to caution against unnecessary losses (of which there are plenty still despite the warnings), it also acts as a red flag for women to not go near it, which may be an unintended side effect.

Getting Women into Crypto

There are a few ways to encourage women to give crypto a try. These ideas need to address the concerns women have with crypto and tech in general for them to work.

“Crypto is risky”

New developments are happening every day in crypto. Untested or new ideas inherently carry a certain level of risk which is part and parcel of dealing with it. We need to help women understand what is risk, risky behaviour, and the probability of events occurring with a negative impact.

For example, holding a share of Amazon is generally seen to be less risky than holding Bitcoin. However, holding Bitcoin is less risky than holding an unknown token created one month ago that went up 200% during that period because the probability of it crashing down is a lot higher. The more one knows, the better one can minimize the impact that risk brings.

Interest in STEM in girls

It used to be that we had gender-specific toys for boys and girls which is where the conditioning begins about what is or isn't deemed acceptable for boys and girls to be interested in. In recent years though, toys have become less gender-oriented, aiming to give parents more choices in bringing up their children. Not all girls would find STEM subjects interesting and it's the same with boys. For those who are on the fence, more exposure and role models of women in tech being cool can certainly go a long way to inspire girls to be involved in STEM subjects, If we want women programmers and coders (or even involved in AI), gotta start them young!

Glamorisation of “tech bro” founders

The industry has a problem of glamorising founders who are almost inevitably men. We saw what happened to Sam Bankman-Fried. There's no doubt that he has a questionable character, but everyone who was involved in treating him as the poster boy of crypto ought to take some measure of responsibility in contributing to the ballooning of his ego. Women founders are few and far between and often do not get the spotlight that men do. The most famous female tech founder, Elisabeth Holmes, is unfortunately not well-known for good reasons.

Neither female nor male founders grow on trees but women have less space to nurture their talents. Most women working in tech are in the non-tech departments such as HR, Finance, and Marketing. Mostly men work in product and engineering. How about a bit more crossover between these spaces, especially for women to be involved in product, if not engineering?

The more women get to be in the product space, the higher the likelihood that they can come up with an idea that puts them in the founder space. Even including women in product testing phases would make a significant difference to the reception of a product or service if it is aimed at the general public.

Tech information presentation appealing to women

Consider tailoring educational pieces and tech presentations in a manner that is easy for women to relate to and understand. It's not about dumbing down or talking down to women. Rather, it's disseminating information in a way that is more relatable for women. For example, if having more savings is a financial goal, talking about the benefits of this such as being able to go on a nice holiday and imagining the enjoyment one gets from it is much more effective than just asking for money to be put aside with no definite plan in mind. The emotional value of something has a far greater attraction than a rational one.

The above suggestions are just a start to trying to get more women into crypto. I'd like to put a big caveat here by saying that this is a very broad-stroke approach to most women's perception of crypto. There are, doubtless, women who are exceptions to the general rule and they usually remain a minority. Crypto is about getting as many people on board as possible so that the results are as colourful and diverse as the myriad of people in the world.

Individuals With Impaired Vision

1.1 billion people globally are living with vision loss in 2020, according to Vision Atlas. There's also the potential for this number to increase to 1.7 billion by 2050. This is out of the roughly 8 billion people on the planet.

That's almost one in every 8 people who have a vision problem. This is a sizeable number of people who have great difficulty getting into crypto, mainly due to accessibility issues. What is even more troubling is that the majority of them tend to be in developing countries and affect seniors and women.

Back in 2017, someone had already thought of this problem. There was an initiative for a Braille version of the Bitcoin white paper to be published. Since then, there have not been many, if any, concrete ideas on how Bitcoin and crypto can be made more accessible to the vision impaired. This Reddit thread, started in 2024, shows that people have started thinking about it. Perhaps they know someone with vision impairment or they might even know a blind person who is more into crypto than they are! How then do they navigate in this world mainly designed by the sighted? How can they verify without trusting?

A similar area where the visually impaired have often been sidestepped is the gaming space, which also has an accessibility issue. For years, they were a marginalised group yet in recent years, game designers are starting to actively court this group. Not only are accessible options placed at the opening screens of games (as that will likely change the way you experience the rest of the game), but game designers are going further by inviting blind gamers to be part of the development process, and later on, as test players. This is the kind of feedback necessary to ensure that what is created is truly relevant to your target audience.

This is a leaf that the crypto community can take from the gaming industry to include blind users to the various dApps and wallets that are used by users. Perhaps even trading platforms and DEXes can also look at what they can do to cater to the visually impaired community.

Below are a few ideas for consideration, even if they seem to be pie-in-the-sky thinking:

VR headsets

VR headsets are once again a hot topic thanks to the Apple Vision Pro (selling at a hefty $3,499 per set). Like with most VR headsets in design, this is designed for the sighted. Still, prototypes need to be created so that we can have better versions down the road. A big thank you to everyone FOMOing into the early designs, paving the way for everyone else who can then buy it at a fraction of the price with much better features in 5 years. 😉

Once we have hit the mass adoption mark for this, perhaps it's time to consider expanding the market to allow the blind to see with the help of VR headsets.

Seeing involves not just the eyes because the brain also plays a big part. Think of the eyes as a tool to detect patterns of light. The cornea and pupil help to gather and narrow the appropriate amount of light to hit the retina. It is the retina that sends the signals to the brain where the interpretation occurs. The brain receives the signals and decides whether the pattern fits a square or a rectangle.

Depending on how the blindness occurs, if the retina part is intact, then there only needs to be a device that detects light and patterns for it to interact with the retina. The rest would function as normal. If damage is done to the retina where the signals to the brain are disconnected, that's where something like a neural link chip might work to interface with the brain so that the brain can do its job.

Of course, the sooner we get started on this, the better.

Wallets and dApp Interfaces

Perhaps designing VR headsets for the blind to see is a costly undertaking and may not happen for years. In the meantime, we still want the blind to be engaged with crypto. One way to do so is with the interfaces that crypto currently uses to interact with users.

Wallets can be designed in a way that is compatible with how the visually impaired operate in a seeing world. This could be:

- Less reliance on QR code scanning,

- Better integration with screen readers and text-to-speech software,

- Have more sophisticated software that can tell the difference between homophones, i.e. words that sound the same but spelt differently, like “hour” and “our” when it comes to seedphrases.

Just like the gaming community, get the blind involved in the design and development process and test them with blind users so that what comes to market is relevant to the target audience.

Blockchain games can also be designed with the blind in mind. Sighted players may even have the option to collect badges and others by playing the alternate version, blindfolded. That might bring up some interesting discussions between both communities that may hopefully allow the sighted to walk a few minutes (or hours) in the shoes of the blind. Who knows, maybe some of those design ideas can also benefit sighted players in a different way.

Illiterate Users

It's difficult to imagine, for many of us in this day and age, that illiteracy could even be an issue. This is a good thing that we take literacy for granted because education is de facto in most people's lives as part of a healthy childhood. Yet there are still places around the world where it is possible to be illiterate and still survive, but not thrive.

As you can see from the map above, the majority of illiterate people are still on the African continent. What is heartening is that this is fast becoming a problem of the past as the younger generation are more likely to be literate than their grandparents. As the world strives towards a global literacy rate of 100%, this will no longer be a problem faced by crypto users. For now, we acknowledge that those who are illiterate cannot access crypto and the only way out is through education.

Another angle in viewing the illiteracy problem is through the gender lens. It is no surprise that “Of the roughly 781 million adults worldwide who cannot read or write, nearly two-thirds are female. This disparity is particularly noticeable in less-developed countries, in which women are often expected to stay at home and care for the house and children while the men go off to work.” - Source: worldpopulationreview in their report on literacy around the world.

Seniors Using Crypto

The number of illiterate seniors from the map above shows the double dangers of being a senior citizen in our modern-day civilisation. It's difficult enough being a senior attempting to use crypto, whether it's for the first or umpteenth time. Although there are fewer obstacles in terms of accessibility, education is not the only important driver in getting seniors over the hump. A key aspect is a general way of how things work. Older generations are usually more trusting and used to custodial services, which, unfortunately, are where most investment scams occur. To them, it's not easy to understand “don't trust, verify" as many of them were brought up in a more community-minded manner.

As the world's population starts to age, it's sad to say but if one doesn't manage to get into crypto by a certain age, it will become progressively harder and harder for acceptance as one ages. It's not that crypto is a young person's thing, it's simply that it can upend the way we understand how things used to work, and that can be a terrifying prospect for some, particularly if one is in the type of job that would likely be supplanted by a smart contract in the future.

It's one thing to give them the facts about how blockchains and crypto work but it is still an unfamiliar world for some of them and it would take a lot of practice to get used to it. Some, however, may never will.

Lack of Access to Electricity and the Internet

The speed of climate change and the slowness in adapting to the change plus the lack of spending on infrastructure to accommodate new energy grids and various related developments means that there will be more and more pockets around the world that will experience a lack of electricity. Whether it's a temporary brownout or a blackout that could last for days/weeks on end, those caught in this would have no access to their crypto. To those who say there are still paper wallets, I say: darling, paper wallets do not help the crypto space to thrive.

If you have electricity but no internet, that's also another hurdle to overcome. Not all of us are fortunate enough to have StarLink in our area or be able to afford one even if there is. In addition, it is still possible for certain countries to cut off Internet access for their citizens (think North Korea). I doubt those countries would allow StarLink to operate above them unless they don't know about it, which is unlikely.

I can't think of any possible solutions that could overcome these issues so I can only chalk it up as a concern. These are also people who would not be able to access crypto like many in the world can and with ease.

Challenges faced by the Majority

Even for the able-bodied and sighted who want to use crypto, there are still challenges lying in wait for them. These crypto users do not have accessibility issues, but there are other problems they need to overcome. A big pain point for those who choose to go the self-custody route is “recovery seed risk”, namely, the inability to provide their seed phrase to recover their access to the wallet. Without access to the wallet, they lose access to their crypto.

You could lose the hardware wallet and still get access to the balance as long as you have the seed phrase. This is why you hear of scammers who steal seed phrases because they don't need the hardware, only the seed phrase to gain access to your money.

On the other hand, the risk of going custodial is also one that bears serious thought. If you end up in an FTX or Celsius, there's nothing much you can do but pray.

Speaking of bad actors, regular crypto users also need to watch out for hacks, phishing scams, fake airdrops, and fake tokens just to name a few. A majority of the hacks come from cross-bridge protocols. Hackers are attracted to the amount of liquidity in these protocols as a certain level is needed for the swaps to be successful. Users just need to get in, get out and don't spend too much time in there unless necessary.

When it comes to blockchains interacting with each other, the fact that we need bridges means that the cross-chain capability is still not as efficient as we would like to be. Therefore, it is also important to check the blockchain supported by the receiving end before making any transfers. Any transfers made on an unsupported network or sending tokens that are not supported by the receiver fall into a black hole. That's millions of dollars that cannot be accessed by anyone.

To make things just a bit easier and still very much safer for users, the concept of Account Abstraction was introduced, with protocols like zkSync and Staknet working on applications that use this concept. With this concept, people can have something like “forget password” to regain access to their wallet balances and have the third-party developers pay the gas fees on behalf of users. This would hopefully make crypto a bit more forgiving than it currently is when things don't work properly or incorrect usage.

Other companies like eToro, Robinhood, and PayPal see an opportunity to make crypto easier to use by promoting themselves as a kind of “superchain”. Since the general public is already familiar with how these services work, they position themselves as a gateway to crypto by layering their interface and logic over the crypto dApps so that there is less friction for users as everything happens on their websites while the crypto stuff is now under the hood.

Conclusion

It's worth mentioning that one of the side benefits of using crypto is that for some, it also comes with a dose of financial literacy. It is generally known that literacy and financial literacy rates do not go hand in hand. This study published by the Ohio State University Library highlights this gap, even amongst the top 10 most literate nations in the world, including the US. Educating everyone about crypto can also give them some financial literacy skills that they can use, even without crypto. It is the best “killing two birds with one stone” reason for allowing more people access to crypto.

Note that the groups mentioned in this article are not mutually exclusive to each other. An individual can belong to some or all of them. The more groups you find yourself in, the greater the risk of being sidelined by society. All the groups mentioned, including women, have always been short-changed in one way or another by society as it developed over the ages.

Even if it's been the norm for the longest time, it doesn't have to be moving forward. One way to break this cycle is by getting these groups involved as early as possible from the get-go, all the way to the testing and product launch, and improving feedback gathered from the users in the targeted groups. Only then can we ensure that what is created is truly suitable for all groups, and crypto can finally live up to its credo of being diverse and inclusive.

Editors Note: The opinions and views expressed in this article are those of the author and do not necessarily reflect the views and opinions of the Coin Bureau or its affiliates.

Frequently Asked Questions

Yes, but there is much room for improvement. Crypto engagement amongst women is still very low. There are also other marginalized groups that have difficulty accessing crypto.

If we want crypto work well for everyone, we need to take into consideration the variety of situations and types of people using it and design for those scenarios so that everyone can get the greatest benefit from using it.

If someone near and dear to you has difficulty accessing crypto, you want them to have an easier time doing so. For everyone else, all manners of improvement in crypto can be beneficial in unexpected ways, directly or indirectly.

If you or someone you know are working on a crypto project, encourage them to broaden their thinking about who the user is and get different types of people on board from the design phase through to the testing phase.

If you have an idea on how to make crypto more accessible to others, make a proposal on your favorite crypto project to get support.

If you are a regular crypto user, offer your assistance in community forums to others who may need help.

Disclaimer: These are the writer’s opinions and should not be considered investment advice. Readers should do their own research.